A solid due

diligence process reduces risk and as a part of that process, the due

diligence questionnaire (DDQ) simplifies the collection and delivery of important

information. Questionnaires are generally about financial information such as

source of wealth, source of funds; security; pending legal matters; KYC forms

etc.

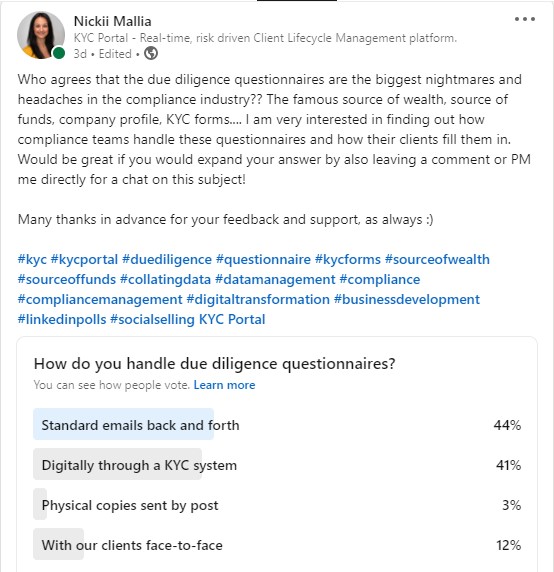

A DDQ is a list of questions designed to evaluate aspects of an organisation or individual prior to a transaction. The amount of information and documentation that must be collected and studied requires a significant amount of time, headaches and attention to detail. DDQs are there to enable organisations to gather large amounts of data quickly and efficiently, however, not all organisations use a quick and efficient process.

A LinkedIn poll we recently published resulted that the most common method used to handle questionnaires, was through standard emails back and forth. The reliance on email communication with subjects throughout on-boarding and ongoing aspects of KYC and due diligence is a nightmare. Chasing subjects on missing information, receiving data and questionnaires as attachments to emails and many other tasks lead to various concerns. From the security of attachments in emails, misplaced documents, auditing all communication and also concerns of GDPR. Then once you have everything in hand, someone must physically leaf through all the documents and information and assess the subject’s risk and any other ancillary information that might be required. This in turn will once again trigger requests for further documentation leading to endless to-ing and fro-ing with customers.

The most ideal and efficient way of handling questionnaires is

digitally through a KYC system such as KYC Portal. The Questionnaires module in

KYCP allows the head of compliance to add as

many questionnaires as they want, they can digitize all of them into the

system, link them to their entities, there is no limit as to how many questions

you create in one questionnaire. You can add the question text, description and

even tool tips on how to fill it in. If you have multiple choice questions the

system allows you to be able to associate risk with the answers in the

questionnaires, in advance of them being filled in, so as soon as the client

starts filling it in, the system is instantly risk assessing it and updating

your risk dial. You can also link answers in the questionnaires to a field you

created in KYCP, so it is automatically populated and therefore included in the

risk profile.

So, how are questionnaires filled in?

KYC Portal's embedded e-mail function gives you direct communication with your client, reducing the manual effort of collating all the necessary information through standard emails. The only information you need to collect initially, is their email address and mobile number. Once you have these stored in KYCP, you can send your subject direct secure links via email, through KYCP. Such customer access is secured via SSL and also by 2 factor authentication on their mobile phone. Once authenticated, the subjects themselves will be able to fill in all the questionnaires you sent them, along with any additional document requirements. You are in full control of defining such requirements through KYCP itself, you define the fields, the questionnaires and the documents that are required. This email link can be triggered manually by your team to any subject you have within KYCP.

All this while being linked to your KYC Portal's back-end; the system is auditing everything that is being submitted and assessing your risk, in real-time based on the values and information that the subject has submitted.

When it comes to your B2B customers, since their due diligence process is much more complex, we recommend making use of our Customer Outreach Tool (COT). COT is a plugin in KYC Portal that gives you full control to define all the regulatory processes of what needs to be collected. It lets you define the forms, questionnaires, and document requirements. Once defined you can give your customer their own login access to COT, to be able to manage the entire process themselves. The customer will be able to create their company structure and the system will automatically load the respective required documents, questionnaires, and forms. The client will also be able to start filling in all the details and as well as the ability to add notes throughout the process. COT will automatically guide the customer into what you are expecting based on the type of entity.

COT also calculates risk in real-time based on the data that the customer is inputting. This will instantly refresh the questionnaires and documents that you request based on enhanced due diligence procedures. Once done the customer would be able to submit the entire application, instantly transferring all the data to your KYCP with all the details finalised and uploaded with the risk instantly calculated.

KYC Portal was built specifically for the compliance function within organisations, the requirements of which were actually drafted by senior personnel within compliance functions in various industries on the market. This knowledge helped us in building the most dynamic and complete end-to-end Client Lifecycle Management solution on the market, in order to help organisations stay compliant with all the regulatory changes, on top of competition, all whilst being in full control and risk exposure reduced to a minimum.

For more info contact us directly on info@kycportal.com or schedule your live demo with us today.